The discussion of Hua Xizi should not be limited to the anchor.

The continuous fermentation of the Li Jiaqi incident not only caused the sales of Huaxizi to drop, but also put the brand itself in the spotlight. A topic of "Huaxi’s foundry is a Japanese-funded enterprise" has also recently boarded a hot search in Weibo.

Confirmed by Investor. com, a considerable part of Huaxi’s suppliers (foundries) are indeed foreign-funded backgrounds. Nevertheless, it still can’t change Hua Xizi’s status as a "domestic product", and it’s hard to hide the fact that the employees of foreign-funded foundries are all from China.

The rise of live broadcast with goods is a game of making money, so Li Jiaqi, Viya and other head anchors can actually gain control over the sales channels. For consumer goods, channels are too important. But consumers care more about whether domestic products can stand up than what Li Jiaqi said.

What percentage of foreign capital is "concentration"

From the perspective of ownership structure, Hua Xizi’s status as a "domestic product" is beyond doubt. Enterprise investigation shows that its sole shareholder is Zhejiang Yige Beauty Cosmetics Group Co., Ltd., and Zhang Dayong, executive director and general manager of the company, and Wu Chenglong, supervisor, are also from China.

The "Japanese-funded foundry" of Hua Xizi questioned by netizens is indeed true. Not only that, but after combing the product information of the top 10 and top-ranked products in the flagship store of Huaxizi Tmall, Investor.com found that more than half of the producers of these products are foreign investors.

The foundries of Shouwu Eyebrow Pencil, Air Honey Powder, Silk Honey Powder and Flower Dew Cleansing Wet Wipes are: Shanghai Chuangyuan, Shanghai Zhenxin, Shanghai Ourun and Hangzhou Huaningxiang. The manufacturers of these products are all domestic-funded enterprises, and Hangzhou Huaningxiang, the manufacturer of makeup remover wipes, may be Huaxi’s own production capacity.

In the foreign investment part, we should first look at Hua Xizi’s makeup set, whose sales volume itself is low, but because of the topicality at the beginning of listing and the design sense of the product itself, Hua Xizi put it at the top of the list. According to the product information on Tmall, its manufacturer is Suzhou Annokos Cosmetics R&D Co., Ltd. (hereinafter referred to as "Annokos").

The largest shareholder of Anokos is Axilong Shunhua Aluminum Plastic Industry Co., Ltd., holding about 87.5%, while the latter’s major shareholder is a subsidiary of Spain Axilong Metal Co., Ltd., holding about 60%. In addition, two Korean shareholders hold about 12.5% of the shares. Generally speaking, foreign capital accounts for more than 50% of the shares in Annokos.

The Japanese manufacturer Dongse Daily Chemical mentioned in the hot search produces a four-elephant balanced skin-sticking liquid foundation. The manufacturer is wholly owned by Japan Dongse Cosmetics Co., Ltd.; Koma Cosmetics, the manufacturer of Yurong Yunsha sunscreen makeup cream, is a wholly-owned Korean enterprise; Lixin Biotechnology Cosmetics, the manufacturer of Yurong Ningzhi Makeup Powder, is a Hong Kong-funded enterprise.

In addition, Kesimeishi, a manufacturer of products such as Jade Girl Peach Blossom Light Honey Powder, was established in 1992 and has a long-standing reputation in the beauty OEM industry. It is also a Korean enterprise. It is worth mentioning that this foundry also established Shanghai Yige Ningxiang Biotechnology R&D Co., Ltd. together with Hangzhou Huaningxiang Biotechnology Co., Ltd. behind Huaxizi.

Moreover, Cosme also invested in Perfect Diary Cosmetics (Guangzhou) Co., Ltd. and Yixian Biotechnology (Guangzhou) Co., Ltd., both holding 51% of the shares, which is also deeply related to Perfect Diary.

The above 11 products involve 9 manufacturers, among which 5 are foreign-funded manufacturers. Huaxizi itself is a domestic product, but the proportion of foreign investment in its cooperative foundries is indeed not small.

Channel dependence needs to be broken

For consumer goods, sales channels are always a problem that enterprises need to pay attention to.

In particular, the light-asset beauty brands such as Huaxizi, Tangduo and Perfect Diary, apart from focusing on enhancing brand value through marketing means, lack of online sales channels has always been the fate of these brands.

After Li Jiaqi’s "accident", Hua Xizi’s problem was obviously magnified. Hua Xizi was established in 2017, and the cooperation with Li Jiaqi began in 2019. Since then, Hua Xizi’s fame and sales have been closely linked with this man.

In April 2019, Hua Xizi launched a "micro-carved star dome carved lipstick". After the promotion of this product in Li Jiaqi the following month, the sales increased to 5.948 million yuan, up 165% from the previous month. Although this lipstick bears the label of "flashy" and "reluctant to use", its sales volume has increased rapidly. By November of that year, its sales volume increased to 23.952 million yuan.

Li Jiaqi also became Hua Xizi’s "chief recommender" in September of this year. In 2020, the cooperation between the two companies will become more intensive. The Huaxi sub-brand entered the live broadcast room in Li Jiaqi 71 times, with an average of 5 times a month, and the number of cooperation in May of that year was as high as 10 times. In 2019, the sales of Huaxizi was about 1.5 billion yuan, which exceeded 3 billion yuan in 2020 and 5.4 billion yuan in 2021.

According to the data of Foresight Economist, in 2020, more than 30% of Huaxi’s traffic will come from Li Jiaqi’s live broadcast room and Tik Tok, and Li Jiaqi’s contribution to Huaxi’s GMV will even exceed 60% in such critical periods as various shopping festivals. In February, 2020, 80% of Huaxi’s sales came from online, and 40% of them came from the live broadcast room in Li Jiaqi.

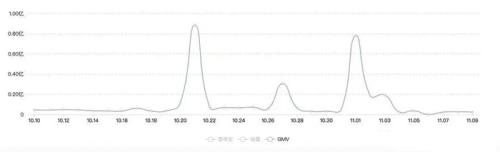

According to the data from October 10th to November 9th, 2019, the average daily live broadcast of Hua Xizi in Taobao is about 200, but only the live broadcast in Li Jiaqi can bring the peak of sales.

The "Matthew effect" in the anchor group with goods in the head is a cliche, and this ending has its inevitability. After the MCN organization ran out several head anchors in the early days by casting a wide net, these heads themselves have become a "famous brand" with strong endorsement ability. With a huge number of fans, they can get the source of the head brand and talk about the lowest discount on the whole network.

Few consumers can resist the "triple whammy" of head anchor endorsement+well-known brand products+the lowest price of the whole network, and the solid guarantee of sales volume also makes the brand side more inclined to choose the head anchor. This kind of channel monopoly, which is difficult to define and exists objectively, is formed, so that it is difficult for the platform to break this monopoly by transporting traffic to KOL and even KOC.

What Hua Xizi has to face today is that Li Jiaqi made a mistake and the public relations department resigned, while his own offline channel is still in its infancy. On December 19, 2022, Hua Xizi opened the first offline store near the West Lake in Hangzhou, but there is still no exact news about the subsequent store opening plan.

As of January, 2023, there were about 20 offline stores in China. By the end of 2022, there were 158 stores of Perfect Diary.

Are all fellow travelers

To some extent, Perfect Diary, Huaxizi and Tangduo are all fellow travelers. They were born at the end of the blowout era of the Internet industry, but they got on this express train after all. Xiaohongshu, Tik Tok, Taobao live broadcast, these are the explosion points of new e-commerce. On these platforms, new brands have the opportunity to stand on the same starting line as old brands.

The fastest runner is Perfect Diary, and its parent company Yixian E-commerce successfully landed in the US stock market.

In January 2019, Perfect Diary opened its first offline store in Guangzhou. After listing, Yixian E-commerce also indicated that it will use 30% of the raised funds to support business growth and expansion, including increasing the number of offline stores. In terms of its own production capacity, in August 2023, the first factory of Yixian E-commerce was officially put into operation. The partner of the project was Kosmet, with Yixian E-commerce holding 49% and Kosmet holding 51%.

It is worth mentioning that Kosmet also has similar cooperation with Hua Xizi.

In terms of R&D, in recent years, the R&D investment of Yixian E-commerce has been maintained at a high level, and 30% of the listed funds have been used to seek potential M&A targets. Yixian E-commerce has also intensively acquired a number of high-end skin care brands before and after listing. After receiving the delisting warning from NYSE in April, 2021, the company also said that the beauty industry as a whole will shift from channel bonus-driven to product and brand-driven stage, which will increase investment in skin care and makeup products.

During the channel bonus period, domestic brands only need to pull up a team, build a brand and contact a group of foundries, so it is easy to make high sales with the help of channel bonus, and even get a high valuation in the primary market. However, after all, the foundry is an "industry bus", and the beauty products themselves lack a moat. Under the light asset game, competitors will emerge at any time.

Yixian e-commerce has almost stepped out of the growth path of an online beauty brand with light assets, which can be summarized as: starting online, opening offline stores, building self-built production capacity and making skin care products.

Judging from the current known information, Yixian e-commerce is taking the fourth step, and Tangduo has just begun to take the second step. From the point of view of opening a store under the Huaxi Sub-line and cooperating with Cosmis, it may be taking the second and third steps at the same time.

Skin care products have higher technical content and naturally have more profit space. Looking at the big brands on the market at present, they may also have a considerable number of products from foundries, but in terms of skin care, they all have their own "housekeeping formula".

No matter what consumers think of an inflated anchor, one thing is certain: they all hope that domestic brands can really stand up.

关于作者