On the afternoon of October 18, the Sichuan Provincial delegation attending the 19th National Congress of the Communist Party of China held a plenary meeting to focus on the report made by the Supreme Leader General Secretary on behalf of the 18th Central Committee. "The report holds high the banner, the theme is clear, and the thought is profound." "The report is cohesive and inspiring. It is a good report that is people-oriented, full of pride, and inspiring." "The report summarizes the results and seeks truth from facts, studies and judges the situation objectively and accurately, and plans for the future."… The report caused heated discussions in the Sichuan Provincial delegation. In light of their own work realities, the delegates actively considered how to focus on goals and tasks, refine work measures, and implement the report of the 19th National Congress of the Communist Party of China according to local conditions.

keyword

Open to the outside world

The original sound of the report: Openness brings progress, but closure necessarily lags behind. China’s door to opening up will not be closed, but will only open wider and wider. We must focus on the construction of the "Belt and Road Initiative", adhere to the equal emphasis on bringing in and going out, follow the principle of extensive consultation, joint construction and sharing, strengthen the opening up and cooperation of innovation capabilities, and form an open pattern of linkage between land and sea, and mutual assistance between East and West.

Luo Qiang, representative of the 19th National Congress of the Communist Party of China:

Better build a national opening-up hub

At noon on October 18, Luo Qiang, a representative of the 19th National Congress of the Communist Party of China, deputy secretary of the Chengdu Municipal Party Committee, and mayor, walked out of the Great Hall of the People, unable to hide his excitement. "Don’t forget the original intention to compose a new chapter, and look forward to the grand plans." After listening to the report, he said he was inspired, excited, and confident.

In the report, Luo Qiang paid particular attention to one word: openness. In his opinion, the Party Central Committee with the supreme leader as the core actively promotes "grand diplomacy", and has never entered the center of the international stage with Chinese characteristics, Chinese style and Chinese style. "In particular, the construction of the’Belt and Road Initiative ‘has reshaped the global economic map, cultural geography and political pattern in the new century, and created new historical opportunities for the country’s economic and social development, including the development of the western region," Luo Qiang said.

The construction of the "Belt and Road Initiative", Sichuan is both a practitioner and a beneficiary, which is Luo Qiang’s intuitive feeling. Take the China-Europe Express (Rong-Europe Express) as an example, the express train from Chengdu goes directly to Nuremberg, Lodz, Moscow, Istanbul and other 20 cities along the "Belt and Road Initiative".

In recent years, the construction of "water, land and air" external channels in Sichuan has been accelerated. Only Chengdu Shuangliu International Airport has 102 international (regional) routes, and the annual passenger throughput reached 46 million passengers and cargo throughput exceeded 600,000 tons last year.

The "big channel" to connect the world has gradually taken shape, and the pace of building a "big platform" for two-way opening up in Sichuan has been accelerating. Tianfu New Area has been upgraded to a national-level new area, and has been successfully approved as a free trade pilot zone. 159 unique ** pilot tasks in investment, trade, financial innovation and other fields have been smoothly advanced. The construction of China-Germany, China-France, China-Italy and other country-specific cooperation parks has been accelerated. The "China-Europe Center" was officially launched in May this year… In the first half of this year, the province’s total import and export trade increased by as much as 5 ****. The total number of international sister cities and friendly cooperative relations in Sichuan has increased to 238

Luo Qiang said that the report clearly insists on opening the door to the country for construction, actively promotes the "Belt and Road Initiative" international cooperation; at the same time, optimize the layout of regional opening up, increase the opening up of the west, and grant greater reform autonomy to the free trade pilot area, which points out the way for us to accelerate the construction of a pan-European and pan-Asian gateway hub.

keyword

Agriculture rural farmers

The report’s original voice: The issue of agriculture and rural farmers is a fundamental issue related to the national economy and people’s livelihood, and we must always take solving the "three rural" issue as the top priority of the whole party’s work. We must adhere to the priority development of agriculture and rural areas, and in accordance with the general requirements of prosperous industries, ecological livability, civilized rural customs, effective governance, and prosperous life, establish and improve the system, mechanism, and policy system for integrated development of urban and rural areas, and accelerate the modernization of agriculture and rural areas.

Yao Qingying, representative of the 19th National Congress of the Communist Party of China:

Promoting rural revitalization has a "navigation map"

The five years since the 18th National Congress of the Communist Party of China have been an extraordinary five years in the development process of the party and the country. As a rural grassroots cadre, Yao Qingying, the representative of the 19th National Congress of the Communist Party of China and the party branch secretary of Lianghe Village, Xilai Town, Pujiang County, feels deeply. According to the "small group micro-living" standard, Lianghe Village has built a new residence for farmers in "Lianghe Yiyuan" and remodeled the "Lianghekou" scattered courtyard. Oil sands roads, tap water, natural gas, and optical networks are connected to every household. Villagers have built small villas and renovated them like houses in the city.

In addition to "visible" changes, there are also "invisible changes". By organizing villagers to independently formulate village rules and regulations, the problems such as burning straw, building indiscriminately, and the environment being dirty and messy that used to be solved by nine bulls and two tigers have now been easily solved. Through the promotion and education of the Chinese Dream, the "Farmers’ Night School" has been well run, and the villagers have been mobilized to bask in the family style and family rules, and the selection of "good children", "good neighbors", "good husband and wife", "good cadres" and "good party members" has made the whole village a happy and harmonious family.

The report proposes to implement the rural revitalization strategy. It is necessary to adhere to the priority development of agriculture and rural areas, and establish and improve the system, mechanism and policy system of integrated urban and rural development in accordance with the general requirements of prosperous industries, ecological livability, civilized rural style, effective governance and prosperous life, and accelerate the modernization of agriculture and rural areas.

"The report of the General Secretary of the Supreme Leader has allowed us to further clarify how we see, how to do, and how to do rural work. It is the’navigation map ‘for us to build a happy and beautiful new village." What to do next? Yao Qingying already has a plan:

Continue to do a good job in the normalization and institutionalization of "two learning and one doing" learning and education, and further strengthen the branch team and manage the party members. "To implement the rural revitalization strategy, grassroots party organizations must give full play to the role of fighting fortresses and lead the masses to work hard."

To plant more green organic fruits, soil improvement and efficient water-saving irrigation will be carried out on more than 4,800 mu of orchards in the village, efforts will be made to build modern orchards, and farmers will be encouraged to develop leisure tourism.

It is also necessary to vigorously develop rural e-commerce, build an "e-commerce talent station" in Murakami, attract professional e-commerce sales teams to settle in Lianghe Village, focus on marketing services, and build a 1,600-ton fruit centralized distribution center.

keyword

Poverty reduction

Report original sound: We must mobilize the whole party and the whole society, adhere to precision poverty alleviation, precision poverty reduction, adhere to the central overall responsibility of the province and the county to grasp the implementation of the working mechanism, strengthen the responsibility system of the party and government leaders to take overall responsibility, adhere to the pattern of large-scale poverty alleviation, pay attention to the combination of poverty alleviation with support and wisdom, in-depth implementation of poverty alleviation cooperation between the east and the west, focusing on the task of poverty reduction in deep poverty-stricken areas, to ensure that by 2020 under the current standards of our country under the rural poor population to achieve poverty reduction, poverty counties are all capped, to solve the regional overall poverty, to get rid of real poverty, real poverty reduction.

Wang Liangcheng, representative of the 19th National Congress of the Communist Party of China:

Only by building strong grassroots party organizations and poverty reduction can we have the backbone

"After listening to the report of the General Secretary of the Supreme Leader, I am deeply encouraged and very excited." Wang Liangcheng, a representative of the 19th National Congress of the Communist Party of China, deputy director of the Price Supervision and Inspection Bureau of Pingchang County, and first secretary of the Party Branch of Limin Village, Shuanglu Township, Pingchang County, was overjoyed. As a front-line cadre in poverty reduction, he has a deep understanding of the "decisive progress in the fight against poverty reduction" pointed out by the General Secretary of the Supreme Leader in the report.

"Poverty reduction is fast, and the villagers’ days are getting more and more prosperous; the party’s policies are good, and the old areas are full of motivation to catch up and surpass; the party is strictly managed and the party is governed, and the entrepreneurial atmosphere of cadres and officers is good." In 2014, Wang Liangcheng and nearly 200,000 party members in government organs across the country were selected to serve as the first secretary of the village. In the past three years, the provincial party committee has established "four major funds" for education for poverty alleviation, medical assistance for poverty alleviation, poverty alleviation and micro-credit insurance, and industrial support for poor villages, providing them with "sewing kits" for "embroidery" on the front line of poverty reduction; 22 incentive and care measures in 5 aspects have been issued to encourage them to take root in grassroots officers and start businesses. " The concern and love of the organization makes us deeply feel that only by taking the lead and leading the masses to work together can we be worthy of the organization and live up to our mission. "Wang Liangcheng said.

How to make the villagers’ pockets bulge is the question that Wang Liangcheng thinks the most. The lessons of previous failures in industrial development have made the villagers worried. Wang Liangcheng invited experts to the village to guide and work door-to-door. He called the successful migrant workers in the village one by one, and carried preferential policy brochures to Guangzhou, Chongqing and other places to persuade them to return to the village to start a business with sincerity. Today, the village has established five professional cooperatives, with 1,500 mu of land in circulation, covering 156 households. The villagers have achieved various incomes through land circulation, park work, and industrial development.

Wang Liangcheng said that combined with the experience and study report of the first secretary of the three years, he deeply realized that only by helping to build and strengthen grass-roots party organizations can poverty reduction be the backbone; only by helping to find the road to prosperity in the industry can poverty reduction be effective; only by integrating into the masses to help, poverty reduction can have cohesion.

keyword

Comprehensive and strict governance of the party

The original sound of the report: The courage to self-revolution and strictly manage the party is the most distinct character of our party. We must deeply understand the long-term and complexity of the party’s governance test, reform and opening up test, market economy test, and external environment test, and deeply understand the danger of spiritual slack, lack of ability, separation from the masses, and negative corruption. Adhere to the problem orientation, maintain strategic resolve, and promote comprehensive and strict party governance to in-depth development.

Song Chaohua, representative of the 19th National Congress of the Communist Party of China:

The great victory of comprehensively and strictly governing the party is inspiring

Song Chaohua, representative of the 19th National Congress of the Communist Party of China and secretary of the Nanchong Municipal Party Committee, believes that since the 18th National Congress of the Communist Party of China, the Party Central Committee with the Supreme Leader Comrade as the core has taken strong medicine to eliminate diseases, treat chaos, pay close attention to the construction of work style, forcefully punish corruption and corruption, highlight clear rules and regulations, and promote strict party governance to achieve an unprecedented great victory. The people are all rejoicing, applauding, and wholeheartedly supporting.

Song Chaohua said that in 2014, the central and provincial party committees thoroughly investigated and strictly punished the case of Nanchong soliciting votes and bribing elections. Over the past two years, Nanchong has thoroughly implemented the spirit of the series of important speeches by the General Secretary of the Supreme Leader. Under the strong leadership of the central and provincial party committees, it has deeply learned the lessons of the case, made every effort to purify the political ecology, resolutely eliminated the residual poison of bribery and election, and promoted the formation of a good political ecology in a relatively short period of time.

Song Chaohua said that practice has fully proved that the central and provincial party committees have thoroughly investigated and strictly dealt with the Nanchong vote-soliciting bribery case, which is very correct. This is a move by strong men to break their wrists, scrape their bones and treat drugs, and comprehensively strictly manage the party’s officials. Not only did it not affect the stability and development of Nanchong, but it also brought unprecedented positive incentives, positive energy and positive effects to Nanchong. At present, Nanchong’s economy and society are developing rapidly and healthily. GDP reached 165.10 billion yuan in 2016, an increase of 7.8%. In the first half of this year, GDP grew by 8.7% year-on-year, ranking fifth in the province in total. The growth rate is higher than that of the whole country, faster than the province, and better than expected

Song Chaohua said that in the next step, Nanchong will study and implement the spirit of the 19th National Congress of the Communist Party of China as a top political task, especially continue to maintain "comprehensive and strict governance of the party, purification of the political ecology is always on the way", resolutely win the "three protracted battles" of governing party officials, righteousness and discipline, and punishing corruption and corruption. Thoroughly eliminate the lingering poison of canvassing and bribery, and never let bribery and election resurface, never let problems happen again, and never let tragedies repeat themselves. (Reporters, Dong Shimei, Zhang Shoushuai, Li Xinyi, Zhang Lidong, Lin Ling)

Representatives of the Sichuan delegation discussed the report of the 19th National Congress of the Communist Party of China, and planned and implemented measures in combination with their own work

Q1 earnings observation: Meituan, which was hit hard by the epidemic, why is the stock price still soaring?

New Game Original

By Camellia

Editor: Lei Yunting

Yesterday, Meituan Dianping released the 2020 Quarter 1 performance report. The data shows that Meituan’s total revenue in the first quarter was 16.76 billion yuan, a simultaneous decrease of 12.6%. The operating loss was 1.72 billion yuan, an increase of 31.6% from the 1.30 billion in the same period in 2019, and the adjusted net loss was 216 million yuan, a year-on-year decrease of more than 40%.

Among them, the food and beverage takeaway business achieved revenue of 9.49 billion yuan, down 11.4% year-on-year; the revenue of the store, hotel and tourism business 3.09 billion, down 31.1% year-on-year; new business and other income 4.117 billion yuan, up 4.9% against the trend.

Although Meituan’s two strong businesses, catering takeaway and in-store, hotel business, have been hit hard by the epidemic, the sharp narrowing of net losses and the stories to be told in the future still make the market full of confidence in Meituan. After yesterday’s financial report was released, Meituan’s share price closed at HK $125.8, an increase of more than 6%.

Today, Meituan’s share price closed at HK $138.9, an increase of 10.41%, and the current total market value is about HK $804.706 billion.

Wuliangye has been listed for nearly 22 years, and its market value is 573.70 billion RMB, equivalent to 623.70 billion Hong Kong dollars; Meituan has been listed for less than two years, and its market value has exceeded Wuliangye (000858). The great charm of the new economy is evident.

1

"Campaign": Reduced commission, withdrawal price

The platform and merchants are originally a community of interests. During the epidemic, Meituan Takeaway launched the "Merchant Partner Commission Refund Program" to provide merchants with free rebates, subsidies and free traffic support to help them tide over difficult times. Hundreds of thousands of merchants across the country participated. In Wuhan, the amount of free commission has exceeded 30 million yuan.

In addition to alleviating the pressure on merchants in terms of free commission, Meituan has also upgraded the "Spring Breeze Action" to the Million Small Stores Program, by providing online operations and other measures to help merchants recover digitally. Newly launched merchants who originally relied mainly on dine-in and needed to develop online channels can enjoy Meituan’s 7-14 days of "new merchant support traffic."

Although the latest financial report shows that Meituan’s commission income in the first quarter was 8.564 billion yuan, and the commission rate was 11.98%, a decrease of 1.5% year-on-year, in the long run, these two measures have accumulated merchants for the Meituan platform. In addition to commissions, the marketing advertising expenses of merchants are also one of the profit channels for the platform, and merchants provide the possibility for Meituan to increase advertising revenue.

Another profit margin for Meituan comes from the cultivation of user consumption behavior.

"Operation Spring Breeze" has enabled many high-quality merchants to achieve a contrarian growth in orders during the epidemic, which has promoted the increase in the unit price of takeaway consumers. According to the financial report, Meituan’s first-quarter catering takeaway revenue decreased by 11.4% year-on-year, the average daily takeaway order volume fell by 18.2%, and the total order volume fell by 46% year-on-year. However, the average price of each order rose by 14.4% to 52 yuan, and the unit price of customers increased significantly.

In addition, since Meituan Distribution was officially established as an independent brand on May 6 last year, as of now, Meituan Distribution has covered 6.20 million multi-product merchants such as catering, fresh food, supermarkets, bookstores, flowers, etc. These categories have become vertical products ordered by users online, and users’ brand awareness of Meituan’s "everything can be home" is deepening.

2

Future: Food + Platform, Diversity

When Meituan listed in Hong Kong two years ago, Meituan’s co-founder Wang Huiwen repeatedly mentioned Meituan’s Food + Platform grand strategy in the face of the media, that is, starting from takeaway, horizontally covering multiple life service areas such as store delivery, home delivery, and travel.

The core of this strategy is to strengthen a single center of gravity, from the most high-frequency catering consumption to other low-frequency areas, to tap the traffic value of other areas, and to better conduct cross-selling.

Meituan’s current new businesses mainly include food and beverage management systems and B2B food and beverage supply chain services, shared bicycles and online car-hailing, and food retail services.

According to the financial report, in Quarter 1, 2020, Meituan Dianping’s revenue from new business and other divisions was 4.20 billion yuan, an increase of 4.9% year-on-year. This was mainly due to the increase in Meituan’s flash sale and micro-loan business revenue, which was partially offset by the decrease in ride-hailing and B2B catering supply chain service revenue (affected by the epidemic).

The growth of new business is conducive to the overall pull of Meituan.

Meituan’s important fresh food retail business – Meituan market and Meituan flash sale are a major highlight of the earnings report. During the earnings call, Meituan CEO Wang Xing mentioned for the first time that the grocery shopping business will be a very key business sector for Meituan. He said that with the increasing demand of consumers to buy food online, this sector will bring more opportunities and imagination to Meituan in the future, so he will continue to invest in this field.

New businesses including Meituan bicycles and online car-hailing lost 1.40 billion yuan in the first quarter, and the operating profit margin narrowed to -33%. However, the cost of shared bicycles decreased by nearly 1 billion yuan, and depreciation also decreased significantly. Meituan has achieved expenditure control on the bicycle business. These all provide imagination for Meituan’s future development, which is conducive to Meituan’s search for a more perfect growth curve.

3

Competing against each other: the new economy, the new battlefield

Wang Xing said Meituan has no boundaries. However, conducting multiple businesses also means facing multiple competitors.

Ele.me, Meituan’s main competitor, has significantly outpaced Meituan’s 28.3% growth in revenue performance with a 41% growth in the past 12 months (April 2019-March 2020).

Ele.me’s ability to widen the gap with Meituan in terms of growth rate is mainly due to Alibaba’s integration of resources. From the Double 11 promotion at the end of 2019 to the reduction of commission for catering merchants during the epidemic, and a large number of merchants coming to Ele.me to open stores, Alibaba has used the so-called "synergistic advantages of the digital ecological economy" to attract a large number of merchants to settle in Ele.me, and even non-takeaway merchants such as Marriott Hotel, Decathlon, major museums, and Xinhua Bookstore. This places new requirements on Meituan’s resource integration capabilities and technological upgrading.

As a giant in China’s express delivery industry, SF Express’s entry into the takeaway market has also brought challenges to Meituan. Recently, SF Express launched the "Fengshi" platform, focusing on food delivery services for the corporate employee market. At present, many well-known brands such as Xibei, Yoshinojia, Ajisen Ramen, and Dicos have settled in.

Although SF Express said that the "Fengshi" WeChat Mini Program is still in the incubation stage and is currently only implemented within SF Express, it does not mean to fight against Meituan and Ele.me. But "Fengshi", which focuses on low-draw points, may use the B-end business to develop the C-end, which cannot help Meituan, a colleague, feel anxious.

In March, Didi announced that it had launched errands in 21 cities, including Shanghai, Shenzhen, and Chongqing. Users could summon errands to buy goods they needed and enjoy door-to-door delivery services. The function of picking up and delivering goods in the same city would also be opened. At that time, Didi introduced that the first batch of Didi errands were served by Didi drivers, who rode electric vehicles to receive orders every day. Eligible drivers could provide errands as soon as possible after training.

Just today, Hello’s logistics business "Hello Express" has been launched for testing. Hello Travel said that Hello Express is an "errand running" project currently being explored by Hello Travel’s Pratt & Whitney Vehicle Division. It focuses on the delivery of small items and has not been officially launched. It is currently under test operation in Dongguan and Foshan.

****

Multiple rivals also mean that the market is vast. As of this afternoon, according to Forbes real-time data, Wang Xing’s personal wealth is 11 billion US dollars (about 77 billion yuan), making him the 20th richest person in China. "We believe that business growth in 2025 is to increase our daily orders to 50 million, and the current data is still a long way off, so we need to further invest in technology in the future." With the strong wind of emerging economies, Meituan is still running.

This article was first published on WeChat official account: New Game. The content of the article belongs to the author’s personal opinion and does not represent the position of Hexun.com. Investors operate accordingly, and please bear the risk.

Dana Education’s Blockbuster Inventory at the Beginning of 2024: A Comprehensive Summary of Events and Curriculum Upgrades

Dane’s January 2024 event

01 AI C++/IoT Full Link Engineer Course Released

On January 1, 2024, Dane IT College released the AI C++/Internet of Things full-link engineer course, which is based on the original C++ course and embedded course and merged into the C++/Internet of Things unified course.

And closely fit the AI large model technology, a large number of AI automatic speech recognition, AI hardcoding assistance, AI project architecture design, AI hardware selection and other technologies.

With the strong blessing of the AI model, students can become C++/IoT full-link engineers in line with the needs of the times.

Note: CSD (C++) and ESD (Embedded) are officially merged into C++/IoT (Course Code: ESD), and the CSD course code has been cancelled.

At present, the ESD courses include a full set of C++ courses and a full set of embedded courses.

02 Released Cloud Computing + Automated Testing Full Stack Engineering Course

In January 2024, Dane Institute of IT launched a new industry course benchmark: Cloud Computing Full Stack Engineer.

The course is based on the original cloud computing infrastructure, keeping up with the new trend of AI and operation and maintenance development integration, and adding AI automation tools and automated testing technologies to enable students to systematically cloud computing, software testing, and Python automated testing from zero to one. With the strong support of AI, students can become competent for cross-disciplinary comprehensive IT skills positions in the future, achieving career breakthroughs and promotions.

03 Released "Intelligent Workplace Office" – data analytics course

January 11, "Smart Workplace Office" – data analytics course at Dane IT College.

The course covers 6 major industries, including 8 methods of data analytics, 10 classic business cases, and 2 must-have popular software, allowing students to learn data analytics courses systematically from zero to one. The data analytics skills and tools in the course are currently needed and commonly used by enterprises, helping students better adapt to the needs of the workplace and achieve career breakthroughs and promotions.

Dane’s February 2024 event

01 Released Pure Blood Hongmeng Native Development Famous Enterprise Customized Course

After Huawei released the HarmonyOS NEXT version on January 18, the IT industry ushered in a long-awaited job recruitment outbreak.

After the Spring Festival, Zhaopin.com statistics show that the Hongmeng application/recruitment market ushered in a year-on-year growth of 2.6 times/4.5 times, and Hongmeng programmers were "robbed";

Dana’s important partners plan to recruit 2,000 Hongmeng native development engineers in 2024.

As a strategic partner of Huawei, Danai immediately obtained the latest version of Hongmeng System developer rights and engineering equipment, and redesigned the existing Hongmeng course to fully integrate the latest features of "Hongmeng NEXT Edition" – immediately launched the "Hongmeng Native Application Development Famous Customized Class" course.

02 Released AGI Business Design Monetization Course

On February 27th, Dane School of Design released the AGI Business Design Realization Course. The course is based on the original UID full-link design, follows the new trend of AI design, and adds a large number of AIGC Text-to-Image and Graphic technologies, allowing students to systematically learn MJ and SD technologies from zero to one.

With the strong support of AI, students can complete unimaginable business design solutions in future design positions, achieving career breakthroughs and promotions.

Dane’s March 2024 event

01 Released AI Big Model Full Stack Engineer Course

What is a big model? A big model usually refers to neural networks models with hundreds of trillions to trillions of parameters. These models are commonly used in natural language processing, image recognition and intelligent driving, processing large-scale data, etc. For example, chatgpt, Tencent’s PCAM.

At present, it is difficult to find talents for large-scale model-related positions, and salaries continue to rise. The average salary of AI operations is about 18,457 yuan, the average salary of AI engineers is about 37,336 yuan, and the average salary of large-scale model algorithms is about 39,607 yuan.

And according to Zhaopin.com, the total demand for jobs related to big models rose by 169% this month. Many people exclaimed: "The future belongs to AI". AI big models – become a must-have skill for Internet practitioners.

In March 2024, Danai Education IT College released the AI Big Model Full Stack Engineer Course in light of the current market talent needs. The course is based on the development of AI applications based on big models and enterprise data, and realizes the theory of big models, mastering GPU computing power, hardware, LangChain development framework and projects and other practical skills.

Danai cooperates with Tencent, and the excellent teaching methods are combined with Tencent’s first-line industrial experience, which not only allows him to master solid skills, but also to gain the latest practices of the first-line manufacturers in the industry.

Courses tailor learning content and solutions for different groups of people, enabling them to solve practical business problems.

Give away a Python basic course worth 10,000 yuan, you can learn it with zero basics, and provide a free value of 298 yuan to use the graphics card of the standard A100 and the experimental platform of Tencent Cloud.

02 ACP World Series Dana Division Auditions

On March 4th, the audition for the ACP World Series "Danai Division" officially ended. 24 students from the graphic group of this audition were shortlisted for the finals of the Chinese region. They will compete on behalf of the outstanding designers from Danai and the whole country. 30 students from the video group were shortlisted for the finals, and the winners will be directly selected.

The ACP World Competition started in 2013 and is known as the "heavyweight world skills competition in the global digital media field". In 2020, Yan Zi of Danai Education won the runner-up in the China Finals.

My wife gave 210,000 stars to cross L and drive 3,564 kilometers to share six advantages and disadvantages.

What is the experience of having a "local tyrant" wife? Let me tell you something. You can buy a car at will in buy buy, provided that you can satisfy your wife. You see, I raised the L in full, without blinking an eye. Not much nonsense. Now the new car has driven 3564 kilometers. Let me share the three advantages and three disadvantages of Xingyue L.

My wife pays, I contribute, and I buy a car to match the top. Anyway, it doesn’t cost me money. What are you afraid of if the meat doesn’t hurt? The version I bought is a 2021 2.0TD high-power automatic four-wheel drive flagship (top-equipped model), which is a top-equipped version with all configurations.

The new car guide price is 185,200 yuan, the purchase tax is 16,000 yuan, the commercial insurance plus compulsory insurance is 7,200 yuan, the licensing fee is charged to 800 yuan, and the new car decoration is charged to 3,000 yuan, which is 212,200 yuan.

At that time, the reason for considering the purchase of Star Yue L was very simple, that is, at first glance, it was very attractive, and my eyes were fascinated, just like seeing a beautiful woman, and my eyes were sucked away. Not only did men like it, but actually my wife thought it looked good when she saw the Star Yue L, and then she looked at the interior workmanship, and the configuration was all satisfactory to her, and finally she decided to choose the Star Yue L.

For example, the electric seat is made of two-color leather, which is very luxurious and fashionable, and the touch of the car is very comfortable; There is also the A-pillar with a fur-turning design, which has a high-grade sense ratio and is not bad. The most important thing is the 12.3-inch LCD instrument and the double 12.3-inch central control display screen. The whole central control looks very scientific and classy. You can’t find one of the 200,000 joint venture cars, can you?

My wife likes the function configuration mentioned above very much, and thinks it is almost the same as a tablet, and it is simple and easy for young people to get started. And the visual perception is very good, concise and atmospheric.

In terms of power, let’s say that the car I bought is equipped with a 2.0T high-power engine with a maximum power of 175kW(238 HP). The peak torque is 350N·m, and the gearbox is matched with an 8-speed automatic manual transmission.

What level is this motivation? To tell you the truth, I haven’t actually tried extreme driving. I mostly use it to commute to work in cities, and I rarely run at high speed. Therefore, the 2.0T+8 automatic manual transmission powertrain equipped by Xingyue L is very strong in daily use, and the power burst is strong, so you will hardly touch its limit.

Let’s talk briefly about the space of Xingyue L. Its wheelbase is 2845mm, which is actually not lost compared with Highlander. Officially, Xingyue L is positioned as a compact SUV. I think it is a medium-sized SUV with five seats. Its rear row space is not as good as that, but it is also very spacious for daily use, which is much larger than the ordinary five-seat SUV.

I’ve talked with you so much. Now my new car has driven 3564 kilometers. I’d like to share some advantages and disadvantages with you. I hope it will be helpful for you to buy a car. Let’s talk about the disadvantages first and then talk about the advantages.

Disadvantage 1: At present, the fuel consumption is 11L, and the fuel consumption feels high.

Now the new car has run more than 3,500 kilometers, and it should be past the running-in period, but I feel that the fuel consumption has not been reduced, and now the fuel consumption is about 11L. Personally, I feel that the fuel consumption is still slightly high, and I hope that the fuel consumption can be reduced in the later period. If it can be reduced to 8-9L, so much the better.

Disadvantage 2: the central control display screen is easy to leave fingerprints and is not resistant to dirt.

The central control panel is also a point that can’t be ignored. After half a year of use, the central control panel is not resistant to dirt, and it is easy to leave fingerprints, and it feels dirty after light reflection. I suggest you pay attention to it during use and wipe your hands as clean as possible.

Disadvantage 3: the engine is not easy to start and stop, and there is obvious vibration when starting.

The engine start-stop function of Xingyue L is not easy to use, and sometimes it vibrates at the moment of starting. In fact, the 3 Angkor Serra I used to drive also has this kind of vibration feeling. It may not be the problem of the car, but the function itself. I suggest that you can turn off the startup function, and your daily experience will be better.

Advantage 1: the interior is luxurious, and the central control big screen is very scientific and technological.

What I am most satisfied with is that the interior is luxurious, and there are dual 12.3-inch displays in the central control. I feel that the luxurious atmosphere in the car is very good. Although this car has landed more than 210,000 yuan, this kind of workmanship and configuration feel no worse than that of a 500,000-class joint venture car.

Advantage 2: The power is particularly strong.

The 2.0T power of Xingyue L is very powerful. Officially, the acceleration is 7.7 seconds. In fact, it is particularly powerful to drive. You don’t have to be afraid of lack of power. As long as you are willing to step on the accelerator, the power will come out, giving you a good sense of pushing back.

Advantages 3: Small steering virtual position and high steering accuracy.

The question that makes me feel incredible is that although the Xingyue L is an SUV, it is very easy to drive, the steering accuracy of the steering wheel is very high, and the steering position is very small. When the star flies over L, you can hit it wherever you point and drive it with ease.

At the end of the writing, someone may ask me, do you regret spending more than 210 thousand to buy Star Yue L? I want to say, no regrets. Xingyue L is the best workmanship and materials of 200,000 class in all aspects. You can’t find one in the joint venture car. You can go and have a look at the cars such as,, etc. Which one has the sincerity to surpass L?

Geely Galaxy’s first pure electric sedan Galaxy E8 is listed, priced from 175,800 yuan

Beijing News Shell Financial News (Reporter Zhang Bing) On the evening of January 5, Geely Galaxy’s first pure electric car Galaxy E8 was listed, with a total of 5 versions launched, priced at 175,800 yuan – 228,800 yuan.

Geely Galaxy E8. Picture/Enterprise official website

Geely Automobile Group CEO Gan Jiayue introduced that the Galaxy E8 is equipped with Geely’s self-developed "Aegis Battery Safety System", providing three battery life versions of 550 kilometers, 620 kilometers and 665 kilometers.

Gan Jiayue said that losing common sense to build a car will not succeed, and losing long-term doctrine to build a car is unsustainable. Only by following the underlying laws of car building is the inevitable way for the long-term success of China’s new energy vehicles.

Editor, Song Yuting

Proofreading, Yanjun Zhang

14.8-18.8 million yuan, Geely Xingyue L opened the global pre-sale.

Today, we learned from the official of Geely Automobile that its new SUV Xingyue L will be pre-sold globally in the official applet and officially listed in July.

It is reported that the pre-sale price of Xingyue L is 148,000-188,000 yuan. With the publicity of the pre-sale price, Geely has also launched a number of exclusive rights for pre-sale: 520 yuan deposit is 2,000 yuan; Buy a car at the pre-sale price, and retreat more and make up less after listing; 2-year 7.8% discount value-added repurchase; Up to 7000 yuan replacement subsidy; 36 zero-interest financial subsidies; 20% discount on Cuiyu Magic Color Suit; Blind subscription users also enjoy pre-sale rights.

Xingyue L is the third model based on CMA platform after Xingyue and Xingrui. In the world’s first test a few days ago, Xingyue L competed with German and Japanese benchmark SUV models on the same stage. In addition, the comprehensive mechanical quality of Xingyue L is ahead of SUVs such as Volkswagen Tiguan L, Honda CR-V, Toyota RAV4 and Rongfang.

From the overall appearance, the body line of Xingyue L is hard-line, which is a conventional urban SUV style: it adopts a straight waterfall air intake grille with matrix headlights on both sides, giving people a tall and tough visual experience. Xingyue L has a body length of 4770mm, a width of 1895mm, a height of 1689mm and a wheelbase of 2845mm, and the body size exceeds the level of the joint venture brand SUV at the same level.

In terms of interior, Xingyue L pays more attention to the oriental aesthetic design: in the design of continuing the three-spoke multifunctional flat-bottomed steering wheel and airplane-style gear handle, a triple screen layout consisting of a liquid crystal dashboard, a central control screen and a co-pilot screen is added in the central control area.

In terms of security, CMA architecture gives Xingyue L the top security gene. Xingyue L hardware is world-leading and meets the global five-star safety standards in China, Europe and America.

In terms of health, Xingyue L advocates building an all-round healthy car. The car is equipped with CN95 air conditioning filter +AQS air purification, PM2.5 monitoring and protection, fresh air system and G-clean scene mode.

Intellectually, Xingyue L also performed well. Its CMA intelligent evolvable electronic and electrical architecture is twice as fast as the mainstream cars in the market, and its data transmission rate is 200 times faster than the world-class architecture. In addition, Xingyue L is equipped with the strongest Qualcomm Snapdragon 8155 chip, which supports 5G high-speed network and drives multiple screens with one core.

In terms of power, Xingyue L adopts Borgwarner’s latest generation of four-wheel drive technology in the world: the 6th generation Haldex. The whole system is equipped with Drive-E 2.0TD high-performance powertrain with a maximum power of 175kW. At the same time, Xingyue L achieved a big dimension increase in four-wheel drive performance, and its response speed increased by 16.7%.

The pre-sale price is 199,800, aiming at the polar krypton 007, and the polar fox Alpha S5 will also lift the table.

On April 22nd, BAIC Polar Fox held a pre-sale conference of its Alfa S5 model. At the press conference, BAIC Polar Fox launched two models, namely Alfa S5 708 MAX and Alfa S5 650 ULTRA, with pre-sale prices of 199,800 yuan and 219,800 yuan respectively. It is reported that the new car adopts a series of the strongest black technologies of Beiqi Polar Fox, which not only has a drag coefficient as low as 0.1925Cd, but also comes standard with an 800V high-voltage platform.

With the official opening of the pre-sale of Extreme Fox Alpha S5, Extreme Fox has also provided a wealth of car booking rights for scheduled car owners. Two of the models enjoy a cash interest of 25,000 yuan, and the rights and interests of Alfa S5 708 MAX and Alfa S5 650 ULTRA are 174,800 yuan and 194,800 yuan respectively. In addition, users who order the Alfa S5 708 MAX version before 24: 00 on June 30, 2024 can also enjoy the optional rights worth up to 19,000 yuan; Users who purchase the Alfa S5 650 ULTRA model can also enjoy the optional rights worth 11,000 yuan. In addition, Extreme Fox Alpha S5 also provides a variety of zero down payment, low down payment and low interest financial solutions, as well as basic rights and interests such as lifetime free three-electricity warranty, five-year 120,000-kilometer vehicle warranty, free gift and installation of charging piles, and three-year unlimited free traffic.

More "silent" car design

As a brand-new masterpiece of the brand-new sports coupe style of Polar Fox, the pre-sale Alpha S5 of Polar Fox has a length, width and height of 4820mm *1930mm *1480mm respectively and a wheelbase of 2900mm. The whole vehicle is positioned as a B-class medium-sized car, and its shape is smoother and more agile than the previous models of Extreme Fox, and it also has a sports technology model.

Externally, the polar fox Alpha S5 adopts a brand-new design language of "wind-plastic aesthetics", and the whole body line has undergone meticulous and dense design and complicated wind tunnel test, which makes it have an ultra-low drag coefficient of 0.1925Cd. Such a low drag coefficient not only shows the extreme pursuit of design aesthetics by Extreme Fox Alfa S5, but also is more conducive to the positioning of its pure electric vehicles.

The front face design of the new car is sharp, and the wind-blade headlights composed of 400 LED light sources are full of recognition after lighting. At the same time, it also has the effect of intelligent light language, which is full of science and technology. The side of the Extreme Fox Alpha S5 has a sleek line design, which makes the whole car dynamic. The rear of the car is equipped with a multi-dimensional ultra-red taillight, which not only improves the safety by 40%, but also can identify the identity of Alfa S5 even if it is far away in the middle of the night. In addition, the area of the intelligent active lifting tail at the rear can reach 3430 cm after deployment, which not only makes the whole vehicle feel full of fighting, but also reflects the "rustling" to the fullest.

Sitting in the car, the interior of the Extreme Fox Alfa S5 is obviously in line with the new power car companies, and the overall design is simple and scientific, while not losing the solid materials used by traditional car companies. In many places, the new car uses the Microcloud fiber velvet high-grade leather of Mercedes-Benz EQ, which is not only silky to the touch, but also more environmentally friendly. It is worth noting that the polar fox Alpha S5 is equipped with a panoramic dome with industry-leading thermal insulation effect, with a total coverage area of 5.2㎡, a light transmission area of 4.5㎡ and a light transmission ratio of 78.7%, which greatly improves the transparency of the whole vehicle.

In the interior configuration, the Extreme Fox Alpha S5 has also achieved the leading level at the same price. It is not only equipped with a 68-inch large AR-HUD, a large intelligent central control panel and a 7.1-channel 15-speaker surround sound stage system, which provides users with more wonderful audio and video enjoyment. In addition, for the first time, Polar Fox was equipped with the intelligent cockpit system of Polar Fox Lingzhi OS. Based on this set of advanced software and hardware, the polar fox Alpha S5 cockpit can be transformed into KTV, game room and "Four Seasons Garden" in seconds, greatly improving the car experience of drivers and passengers.

More "trench" inner strength.

As a pure electric car focusing on sports attributes, the Extreme Fox Alpha S5 is not only "quiet" in external design, but also very capable in internal strength.

On the power level, the new car is equipped with a synchronous+asynchronous dual-motor combination, with a total power of 390kW and a total torque of 690 N m, and the zero acceleration only takes 3.7s s. Not only is the acceleration fast enough, but the polar fox Alpha S5 brakes steadily enough. Thanks to the aluminum four-piston brake calipers, the new car only needs 33.5m for 100-degree braking. At the same time, due to the steering system with large transmission ratio, the directivity of Alfa S5 is very accurate, providing drivers with precise control over where to hit.

In order to perfectly reflect the excellent performance of the Extreme Fox Alfa S5, at the press conference, Alfa S5 officially announced the release of the "Tunnel Crossing Challenge" blockbuster, which took the lead in paying tribute to Mercedes-Benz and Schumacher in the name of pure electric cars. In the video, Echo Gao, a well-known racing driver, drove the Alfa S5, rushed into a tunnel with a diameter of 10.2 meters within a limited 320 meters, and found the right angle to use the built ramp to rush into the tunnel wall, completing a 360-degree flip, and finally drifting on the subsequent mountain road. The overall action is done in one go, which shows that the extreme fox Alpha S5 is extraordinary in power attributes.

As a pure electric car, the Extreme Fox Alfa S5 adopts Contemporary Amperex Technology Co., Limited’s Shenxing rechargeable battery, with a battery capacity of 79.2kWh, and the longest cruising range can reach 708km under CLTC comprehensive working conditions. At the same time, the Extreme Fox Alpha S5 comes standard with 800V high-voltage platform, which can charge 380km in just 15 minutes, greatly reducing the mileage and anxiety of users.

In the face of the full pre-sale of the Extreme Fox Alpha S5, the model that directly competes with it will definitely be the Extreme Krypton 007. The two cars are basically the same size, both belong to B-class cars, and both come standard with 800V high-voltage platforms. On the power level, both cars belong to the 3-second club. The difference lies in that the Krypton 007 has a larger power battery and the intelligent driving model has a laser radar, which makes the intelligent driving level more redundant. However, after all, the Extreme Fox Alpha S5 has an advantage in price. Compared with the Extreme Krypton 007, which started at 209,900 yuan, the price of the Alpha S5 after rights and interests is about 35,000 yuan lower. Excluding the added value of the brand, the Extreme Fox Alpha S5 even has an advantage in comfort configuration, and its cost performance is better than that of the Extreme Krypton 007 to some extent.

From April 11th, Polar Fox Automobile released the "New Darwin 2.0 Technology System" in Beijing to April 22nd, Polar Fox Alfa S5 opened for pre-sale. The pace of Beiqi Polar Fox in new energy electric technology has obviously accelerated. Its seven technical fields, such as polar shield safety, extremely clean health, polar front power, aurora battery, extremely enjoyable cockpit, elegant chassis and intelligent intelligence, have been installed in Alfa S5 in one breath, which fully shows the rich background and innovative spirit of Polar Fox relying on old car companies, and also indicates the importance that Polar Fox attaches to Alfa S5 models. The Beijing Auto Show is just around the corner, and the Extreme Fox Alpha S5 will officially meet the general audience at the auto show. At that time, it is believed that the Extreme Fox Alpha S5 will become the most dazzling star model of the Extreme Fox booth, bringing new breakthroughs in sales for the Extreme Fox.

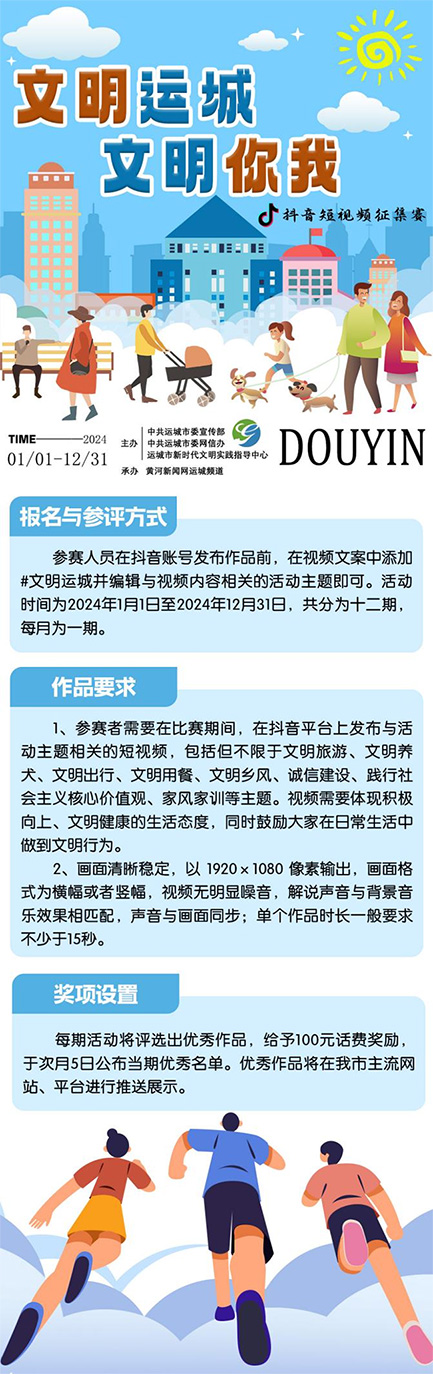

The number of topics played has exceeded 100 million! "Civilized Yuncheng, Civilized You and Me" vibrato short video contest is waiting for you to participate.

Yellow River News Network Yuncheng News (Reporter Li Bingrui)"Garbage sorting, little Lei Feng is in action", "Civilized travel, courteous to pedestrians", "Eliminating potential safety hazards, creating a civilized community", "Tomb-Sweeping Day’s civilized sacrifice, forest fire prevention is everyone’s responsibility" … Since the start of the "Civilized Yuncheng, Civilized You and Me" vibrato short video competition, high-quality works have emerged continuously, and the number of topics has continued to rise. As of April 2, the total broadcast volume of the contest topic has reached 130 million times. The entries depict the happiness of civilized Yuncheng in different forms and from different perspectives.

At present, the winners of the contest in March have been announced. At present, the entry channel is still open for the majority of participants. Participants need to post short videos related to the theme of the event on the vibrato platform, focusing on civilized tourism, civilized dog raising, civilized travel, civilized dining, civilized rural customs, integrity building, practicing socialist core values, family style and family training. Before publishing the work, you should add the topic of "# Civilized Yuncheng" to the video copy and edit the copy related to the video content.

Excellent works will be selected in the monthly activities, and 100 yuan will be rewarded with telephone charges, and the outstanding list of the current period will be announced on the 5th of next month. Excellent works will also be displayed on mainstream websites and platforms in Yuncheng.

Welcome everyone who loves your hometown, pick up the lens in your hand, capture the beautiful moment of the city, show the unique charm of Yuncheng and cheer for the civilized Yuncheng.

- [Editor: Niu Ruimeng]

Huawei’s visual intelligent driving was launched, and the intellectual S7 was released.

□ Dahebao Yu video reporter Xie Yuanli

On April 11th, Huanxin upgraded five models, with the price ranging from 249,800 yuan to 349,800 yuan. It is worth noting that the S7 Pro, the basic version of Huawei Visual Smart Driving HUAWEI ADS, and the Zhijie S7 Ultra with a 100kWh battery pack were officially unveiled. At the same time of this renewal upgrade, new car rights and interests have been added: 30,000 yuan of renewal rights and interests, and 13,000 yuan of owner care for old owners, including 10,000 yuan of cash-filled red envelopes.

Shoufa Huawei Visual Intelligence Drive

Zhijie S7 Pro will be equipped with Huawei Visual Intelligent Driving HUAWEI ADS Basic Edition for the first time, so that a wider range of users can enjoy the fun and convenience of intelligent driving. Without relying on laser radar and high-precision maps, it can realize "the national expressway can be opened quickly and easily, and intelligent parking can be stopped easily"-the national expressway and urban expressway support NCA intelligent driving navigation assistance, intelligent driving up and down ramps, encountering road construction, cone-barrel diversion and other scenes, and have certain ability to change lanes and avoid obstacles. Intelligent parking supports more than 160 kinds of parking spaces, such as special-shaped parking spaces and custom parking spaces, which can be parked immediately. At the same time, the battery pack of Zhijie S7 Pro will be upgraded to 82kWh, and the comprehensive cruising range of CLTC will be increased to 705 km, and the increase will not be increased.

The intelligent driving that you can enjoy when you pick up the car, NCA, Huawei’s high-level intelligent driving city, has been fully upgraded recently, without relying on high-precision maps, so that all the main roads and branches of Zhijie S7 can be opened in 40,000+cities and towns across the country. In actual use, the success rate of smart driving urban elevated import/export is up to 99.2%. Intelligent parking supports parking on behalf of drivers, parking service and remote parking, and covers complex special-shaped parking spaces such as ultra-narrow parking spaces and mechanical parking spaces, which can be stopped by opening and stopping.

The intelligent driving that you can enjoy when you pick up the car, NCA, Huawei’s high-level intelligent driving city, has been fully upgraded recently, without relying on high-precision maps, so that all the main roads and branches of Zhijie S7 can be opened in 40,000+cities and towns across the country. In actual use, the success rate of smart driving urban elevated import/export is up to 99.2%. Intelligent parking supports parking on behalf of drivers, parking service and remote parking, and covers complex special-shaped parking spaces such as ultra-narrow parking spaces and mechanical parking spaces, which can be stopped by opening and stopping.

Intelligent driving is not showmanship, but safety is the true meaning. The omni-directional anti-collision system CAS2.0 protects driving safety in all directions-the effective range of forward AEB is 4-150km/h, and the maximum braking speed is 120 km/h. The effective range of lateral active avoidance is 40-130km/h, and water horses, rows of cones, kerbs, static and dynamic pedestrians, static and dynamic vehicles are actively identified. Backward active safety supports 1-60km/h active braking, actively identifies pedestrians crossing, moving two-wheeled vehicles and vehicles crossing, and reduces the accident probability.

Intelligent driving is not showmanship, but safety is the true meaning. The omni-directional anti-collision system CAS2.0 protects driving safety in all directions-the effective range of forward AEB is 4-150km/h, and the maximum braking speed is 120 km/h. The effective range of lateral active avoidance is 40-130km/h, and water horses, rows of cones, kerbs, static and dynamic pedestrians, static and dynamic vehicles are actively identified. Backward active safety supports 1-60km/h active braking, actively identifies pedestrians crossing, moving two-wheeled vehicles and vehicles crossing, and reduces the accident probability.

Huawei is deeply empowered, and the intellectual S7 has super scientific and technological strength.

Since its listing, Zhijie S7 has gained extensive attention from the industry and the market, and has started large-scale delivery. This renewal upgrade, the Zhijie S7 model family has added the Zhijie S7 Ultra.

Zhijie S7 Ultra is equipped with a 100kWh battery pack, and the comprehensive cruising range of CLTC reaches 751 kilometers. In terms of passive safety and battery safety, the body of Zhijie S7 meets the C-NCAP five-star collision safety standard and the C-IASI collision safety requirements of China Insurance Research Institute. The battery pack is equipped with 13 layers of hard-core safety protection, which will not deform or catch fire during collision and bottoming.

Zhijie S7 Ultra is equipped with a 100kWh battery pack, and the comprehensive cruising range of CLTC reaches 751 kilometers. In terms of passive safety and battery safety, the body of Zhijie S7 meets the C-NCAP five-star collision safety standard and the C-IASI collision safety requirements of China Insurance Research Institute. The battery pack is equipped with 13 layers of hard-core safety protection, which will not deform or catch fire during collision and bottoming.

As the first smart car, Zhijie S7 has been deeply empowered by Huawei in the fields of product definition, ID design, software and hardware development, etc. For example, Zhijie S7 comes standard with HUAWEI DriveONE 800V high-voltage silicon carbide high-efficiency power platform, with the fastest acceleration of 3.3s per 100 kilometers, the lowest power consumption per 100 kilometers and the longest cruising range of 855km. After the super power-saving mode 2.0 is turned on, the comprehensive cruising range of the vehicle can be improved by up to 10%, and the cruising range can be improved by one button. At the same time, Zhijie S7 is equipped with Huawei Turing intelligent chassis for the first time, and has been jointly adjusted by Huawei German Research Institute to intelligently control performance and calmly cope with various working conditions.

As the first smart car, Zhijie S7 has been deeply empowered by Huawei in the fields of product definition, ID design, software and hardware development, etc. For example, Zhijie S7 comes standard with HUAWEI DriveONE 800V high-voltage silicon carbide high-efficiency power platform, with the fastest acceleration of 3.3s per 100 kilometers, the lowest power consumption per 100 kilometers and the longest cruising range of 855km. After the super power-saving mode 2.0 is turned on, the comprehensive cruising range of the vehicle can be improved by up to 10%, and the cruising range can be improved by one button. At the same time, Zhijie S7 is equipped with Huawei Turing intelligent chassis for the first time, and has been jointly adjusted by Huawei German Research Institute to intelligently control performance and calmly cope with various working conditions.

It is worth mentioning that the Super Desktop 2.0 of HarmonyOS 4 system in the intelligent cockpit of Zhijie S7 supports the full boarding of mobile phone applications, and HUAWEI MagLink can expand the screen for the back row. It has the ability of data transmission encryption, sensitive authority management and control, and personal data isolation, and is fully protected against network attacks and has no worries about privacy. In addition, in-vehicle intelligent assistant Xiaoyi will be connected to Huawei Pangu model in May and become a smarter private car consultant.

It is worth mentioning that the Super Desktop 2.0 of HarmonyOS 4 system in the intelligent cockpit of Zhijie S7 supports the full boarding of mobile phone applications, and HUAWEI MagLink can expand the screen for the back row. It has the ability of data transmission encryption, sensitive authority management and control, and personal data isolation, and is fully protected against network attacks and has no worries about privacy. In addition, in-vehicle intelligent assistant Xiaoyi will be connected to Huawei Pangu model in May and become a smarter private car consultant.

The third anniversary of BYD Han family OTA launch push includes Yunnian-C/ITAC, etc.

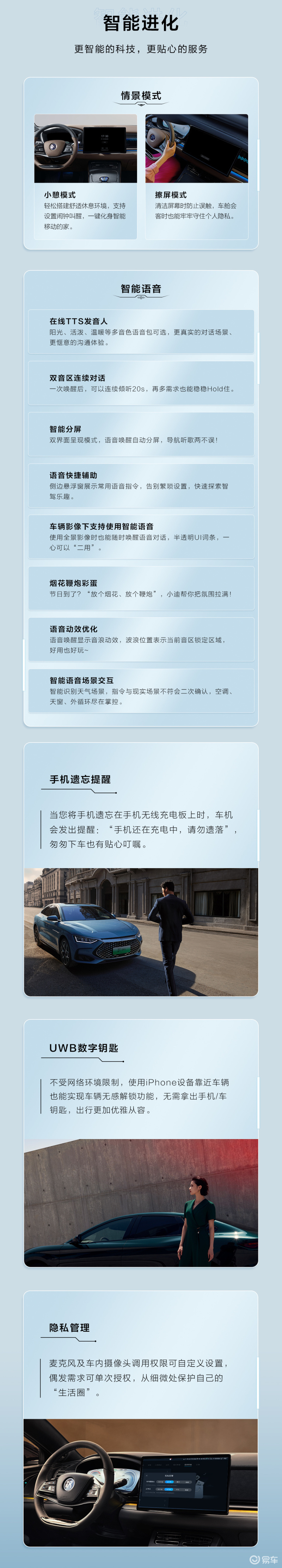

Yichexun On October 23,BYD announced that the Han family will celebrate the third anniversary of OTA, including Yunnian -C, iTAC, voice upgrade and situational mode. From now on, all models will be officially launched in batches.

This OTA upgrade has achieved advanced driving control, and added Yunqi -C intelligent damping body control system, and the suspension damping is adjusted in milliseconds. When the vehicle accelerates rapidly, decelerates rapidly and corners at high speed, the suspension hardness is improved, and the pitching and rolling of the vehicle body are effectively suppressed, thus improving vehicle handling. When the vehicle is driving on the bumpy road, the stiffness of the suspension is reduced, the shock-absorbing performance of the suspension is improved, and the daily driving comfort is improved. In addition, this OTA upgrade also includes iTAC intelligent torque control system, which can dynamically monitor the road adhesion and adjust the driving torque of front and rear axles in real time, effectively preventing vehicles from slipping on stagnant water and sandy roads.

This OTA has also been upgraded in terms of intelligence, and the situational mode has added a nap mode and a screen wiping mode; Intelligent voice has also been upgraded, including online TTS speaker, dual-tone continuous dialogue, intelligent split screen, quick voice assistance, support for intelligent voice under vehicle images, fireworks and firecrackers, voice dynamic effect optimization, and intelligent voice scene interaction. In addition, there is a mobile phone forgetting reminder function. When the mobile phone is forgotten on the mobile phone wireless charging board, the car machine

A reminder will be issued: "The mobile phone is still charging, please don’t leave it behind". UWB digital key: it is not limited by the network environment, and it can realize the non-inductive unlocking function of the vehicle by using iPhone equipment near the vehicle without taking out the mobile phone/car key. Privacy management: the calling authority of microphone and in-car camera can be customized, and the occasional demand can be authorized once to protect your "life circle" from subtleties.

Open the Easy Car App, search for "100,000 km long test" and see the most authentic vehicle long test report.